Online Loans – Apply with CashLady for online decision

What is an online loan?

An online loan is a personal loan applied for and completed online. This means you can do it all from the comfort of your own home using just your mobile phone, tablet or computer.

How much money can I borrow online?

When you apply for a loan online, you will often have a wide range of loan products available to you. High cost short term lenders are often happy to lend as little as £100.

Some lenders will offer loans of up to £100,000 online, but loans of this size are unlikely to be approved without careful consideration and human underwriting.

At CashLady you can apply for unsecured loans and payday loans up to £5,000 online.

How can I apply for a loan with CashLady?

If you apply for a loan online with CashLady, your application will be seen by multiple lenders. The number of lenders will depend on the information you submit in your loan application.

Each lender has different lending criteria. For example, some lenders will accept smaller loans, while some providers will have much higher minimum loan values. Many lenders will not consider loan applications for less than £1000.

When you apply with CashLady, all you have to do is visit our website and fill out the online form. You will need to provide some basic information about yourself and answer a few questions about your financial expenses each month, such as your housing, food, and travel expenses.

Once you have submitted your details, the information is then presented to our panel of online lenders. Once we have an initial acceptance from a lender partner who wants to move your application forward, we then send you to the lenders site to complete the final stages of your application and submit any additional information the lender may require in the process. as part of its underwriting process.

Advantages of online loans

Every day thousands of people search the internet for short term loans online.

Busy lives and work commitments often mean we don’t have the ability to visit a physical location when we need a small loan.

If so, applying for a loan online can be an ideal solution. Especially in an emergency situation when we need to borrow money quickly.

Here are 3 advantages to applying for your loan online:

- Convenience: You can apply 24/7 from the comfort of your home

- Speed: Many online loan providers transfer the money instantly

- Privacy: Many people prefer to manage their personal finances from the privacy of their home.

Online Loans – FAQs

Can I apply for a loan online if I have bad credit?

If you have bad credit, you can apply for a loan online, but you may have trouble getting a loan offer if your credit score is particularly low. Many lenders will look at loan affordability and recent money management as a way to gauge your creditworthiness, which can be very helpful if you’ve recently demonstrated better habits.

What is the difference between a direct lender and an online broker?

If you search for loans online, you will likely see a number of options. What is often less obvious are which providers are the lenders and which are the online brokers.

The difference is that a lender will be able to offer you a loan, while a broker is there to introduce you to a lender. If you want to maximize your chances of being accepted for a loan, an online broker can show your loan request to multiple lenders at the same time to increase your chances of receiving an offer, while keeping loan requests to a minimum.

Will I need a credit check for an online loan?

Yes, if you are a new customer, you will definitely need a credit check before a lender will offer you a loan. Any lender regulated by the FCA (Financial Conduct Authority) must be sure that you can comfortably repay the loan amount you requested within the agreed time frame, so they will not offer you a loan without a credit check.

Do I need a guarantor for an online loan?

There are a number of guarantor lenders in the market, but you don’t need a guarantor to apply for a standard unsecured loan online. If your application is unsuccessful, you may find yourself referred to a guarantor loan provider who may be able to help you with your financial needs.

Are online loans safe to use?

If you are applying for a loan through FCA approved providers, online loans should be safe to use. If you apply for a loan online, remember to check the website for an FCA registration number (usually at the bottom of the website). You then need to verify that the number matches the record on the FCA register. FCA regulated lenders and brokers agree to treat customers fairly. Dealing with FCA authorized companies also means you have a governing body to talk to if you are unhappy with your service.

Although most lenders offer fast application processes and instant money transfers, they must all adhere to the strict guidelines imposed by the FCA.

Most loan providers have undergone numerous changes in an effort to obtain full FCA authorization, ensuring that their products and services are fully compliant, fair to customers and above all safe.

This means that online credit products are now designed with customer needs at the heart of everything.

Do I need a good credit score?

No, you don’t need a good credit score to apply for a loan online, but a better credit score will help you get a loan offer.

What happens if I miss a refund?

If you miss a loan repayment, you may be charged a late repayment fee – usually around £25. If you think you’re going to miss a refund, you should let your lender know as soon as possible, as they may be happy to wait a little longer without charging you.

If you do not repay your loan according to the terms of your loan agreement, you can:

- Be charged additional fees (plus interest) on any missed payments

- Damaging your credit report when lenders notify credit reference agencies

- Be issued with a CCJ (county court judgment)

- Being forced to file for bankruptcy

How online loans work

Online approval process

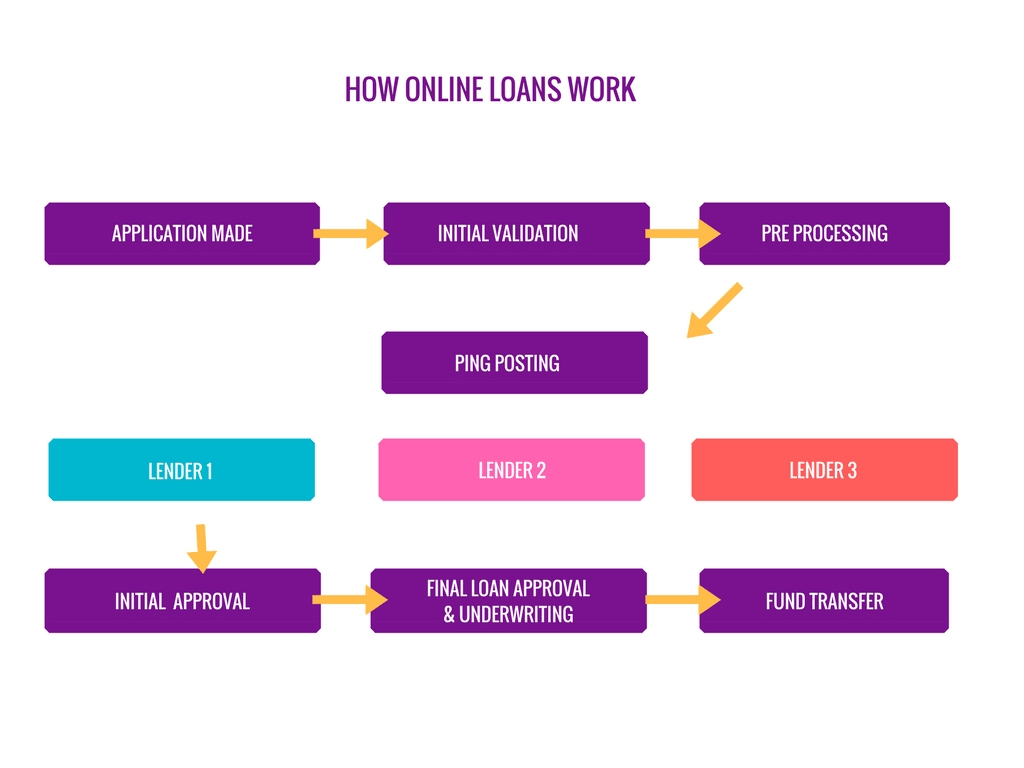

When you apply for a loan online, there are several steps in the process before a decision is made, including:

Initial validation:

Your loan application is validated online through initial validation methods that verify the accuracy of the information entered. This process verifies the validity of your; zip code, phone numbers, email address and a few other details to check that they have been entered correctly.

Post ping:

Your loan application is then sent to several lenders, one at a time. This is the basic processing time required to get your application decision online and it can take up to 2 minutes. You are advised to wait during this process as each lender that receives your application may pull additional data to validate and approve your application.

Initial Approval: If your loan application is approved directly by a lender, your application will be redirected to the online signature page with your chosen short-term loan provider.

Final Loan Approval and Underwriting:

Sometimes small online loan applications cannot be approved instantly and may require human underwriting. This is sometimes necessary if further clarification is needed and may involve additional checks by lenders to verify, validate and assess your application before any money is deposited into your bank account.

Funds transfer:

For instant loans online, this usually happens within hours and the funds can often be in your account the same day.

(learn more about same day loans)

How long does the online process take?

These are quick loans and the online process can take as little as 2 minutes once you have completed your online application form. The time it takes for lenders to approve your application may vary depending on the time of day, time of week, or if they require additional information from you (such as proof of income or documents identity)

Summary: Online Loans

If you’re looking for a loan, chances are you’ll start your journey online, research your options, or apply for a loan.

Applying for a loan online is often faster and more convenient than doing it over the phone or at a branch. It also means you can enjoy more privacy.

CashLady has been helping people online since 2008 and we have developed our website around the needs of our customers. Speed, user experience and excellent service.