Online lending leaves consumers even more indebted, Fed study finds

Online lenders cast themselves in virtuous terms, saying digital innovation has enabled underserved American consumers to refinance costly debt at lower interest rates, while improving their credit scores.

But provocative new research from the Federal Reserve Bank of Cleveland casts doubt on that rosy outlook. Indeed, the study finds that borrowers who use online lending products end up taking on more debt than borrowers in the same situation who do not.

“Consumers in the at-risk category—those with lower incomes, less education, and higher existing debt—may be the most vulnerable,” the research says.

The study, released on Thursday, is expected to spark intense debate. One of its findings is that consumers who take out online loans, sometimes called peer-to-peer or market loans, likely have access to traditional banking services.

This conclusion is in tension with another recent study by another team of Fed economists. These researchers, based at the Philadelphia Fed and the Chicago Fed, found evidence consistent with the argument that online lenders played a role in filling the credit gap left by banks.

“We are scratching our heads,” said Nathaniel Hoopes, executive director of the Marketplace Lending Association, an industry trade group, in an email, “because the Federal Reserve of Philadelphia and Chicago recently conducted a more detailed study and came to the opposite conclusion as this Cleveland Fed research.

Online consumer lending has grown tremendously throughout this decade. In 2010, digital lenders generated $249 million in unsecured personal loans, according to a recent study by credit bureau TransUnion. Last year, the annual volume of loans had increased more than ninety times.

The fledgling industry was generally encouraged by policy makers. Towards the end of the Obama administration, the Treasury Department declared that online lending has the potential to expand access affordable credit for underserved consumers.

The Cleveland Fed study comes to a more unfortunate conclusion. It finds that online industry lending “does not go to markets underserved by the traditional banking system” and “resembles predatory lending in terms of the segment of the consumer market it serves and its impact on consumers.” consumer finance”.

To conduct the study, the researchers relied on data from TransUnion. They identified approximately 90,000 people who took out a loan online between 2007 and 2012. They then used a statistical technique to match these borrowers with other consumers with similar financial profiles, but who did not take out a loan online. .

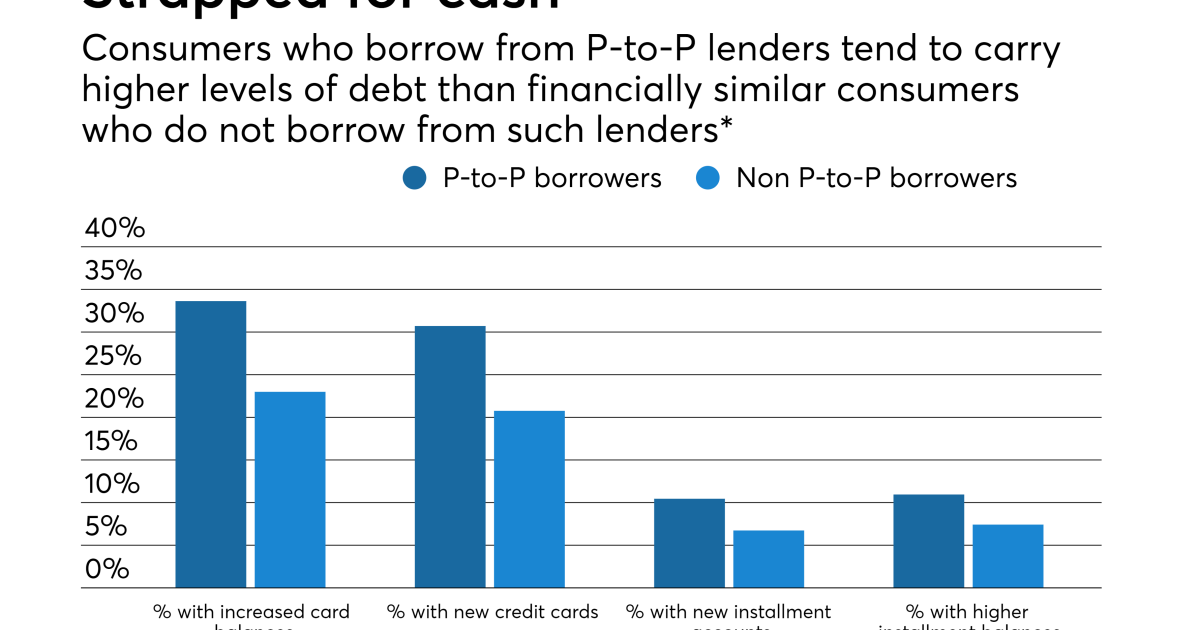

The study finds that consumers who took out loans online increased their other debts about 35% more over the next two years than their counterparts who did not take out loans.

It also found that consumers who borrowed online had lower credit scores, more delinquent accounts, and more total debt outstanding two years later than similarly situated consumers who abstained.

The results suggest that online loans — which are often three- to five-year installment loans of up to $30,000 to $40,000 — are allowing some American consumers to overspend. Even though borrowers are using the loans to pay off existing credit card debt, there’s nothing stopping them from creating significant new tabs on those same cards.

Yuliya Demyanyk, a Cleveland Fed economist who co-authored the research, said in an interview that people who apply for loans online also get credit from the traditional banking system.

“They’re not underbanked, they’re sort of overbanked,” she said.

Demyanyk also expressed concern over rising late payment rates in the online lending industry. His research found that delinquency rates for online loans created in 2013 were higher than for those created in 2012, which were higher than for those created in 2011. A similar pattern of rising delinquency rates appeared on the subprime mortgage market between 2001 and 2007.

“I actually had a moment of deja vu,” Demyanyk said.

A potential criticism of the Cleveland Fed study is that it fails to distinguish between different online lenders who target different consumers and charge widely divergent interest rates.

For example, Social Finance, or SoFi, refinances student loans for consumers with strong credit, while LendingClub offers personal loans to borrowers who often have somewhat lower credit scores, and some other companies charge lower rates. annual percentages well above 36% to customers who might otherwise turn to a payday lender.

The Cleveland Fed research looked at loans classified by TransUnion as online loans. A list of specific companies included in this category was not available.